“I hired a counterfeiter the other day. I told him, “As for your salary, how much you make is really up to you.” I love a business model where the employee pays the employer.” Jarod Kintz, This Book is Not For Sale

As a small business owner you are often the employer and the employee. If there is ONE thing you need to have a maniacal focus on, it is CASH.

You can survive if your revenues dip a little or a key employee leaves or you lose a critical customer. But you cannot survive without cash. Cash is to your business as oxygen is to your vitality.

No cash. You die. Period.

Business growth can be exhilarating. But growth sucks cash. Fast.

You need an easy way to calculate your cash and your cash flow. This post gives you a method and tool to do this.

Where does Cash come from?

There are three sources of cash for small businesses:

Cash from operating the business

Bank loans (this is interest bearing debt)

Equity (money you have built up in the form of assets and monies borrowed form investors—this money does not bear any interest)

We will deal with equity in a later post. For now we will consider just the first two categories.

Cash from operations can be found on your Income Statement. It is the money you have made from selling your products and services less the costs associated with them.

Loans are usually from a bank or lending institution and you have a set amount of interest you pay back each month.

Seems straightforward so far. But wait, life is never so simple. Let’s throw in a slight curve ball.

Where does Cash go? It can be as Slippery as a Fish!

Why?

It has to do with the cash cycle:

1. You make a sale.

2. Services are rendered or products delivered

3. You invoice your customer

4. Customer pays lovely cash into your account.

5. You pay any expenses- with cash of course!

The process rarely goes like this. First in order to make the sale you consume cash in the form of costs by sourcing raw materials or labor for services in order to create the product. They need to be paid.

Customers take time to pay you. Many have 30-day terms. What this means is they don’t need to pay you until 30 days after they received your products or services. In reality many take much longer and a significant percentage don’t pay you at all!

Also in order to service your customers you may need to hold inventory that eats your cash.

So the trick is to shorten your cash cycle between when you incur cost and when you get paid. (We will deal with tips on how to do this later).

But you ask—where is my cash going?

It leaves or is consumed by the following:

Money to pay your suppliers

Cash consumed in the form of inventory (fancy name is working capital)

Cash used to pay any expenses (like salaries)

Any asset purchases (like a new computer or a new piece of equipment)

For now, let’s just get a handle on what our baseline is. We have created a simple fill in the blanks cash calculator in Excel you can download (CLICK HERE OR SEE IT AT THE END OF THIS POST) and it is re-created and explained here:

Cashflow is just the movement in your available cash from one period to the next. It can be done daily, weekly, monthly, quarterly and annually. Given its slippery nature you should have a daily feel for what is happening and at a minimum, weekly.

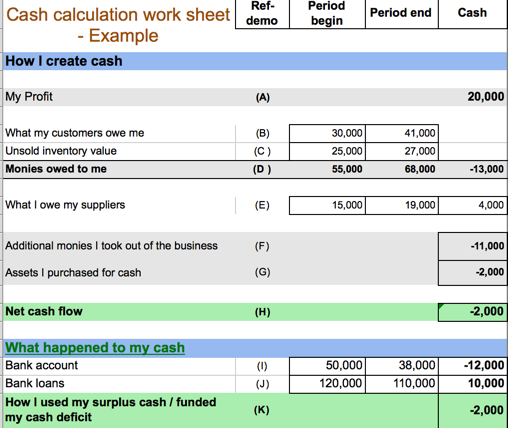

We need to look at two periods. In the above table:

(A) is My Profit and is the cash generated from your Income Statement, in this example the business generated $20,00

(B) What My Customers owe me – this is what you have invoiced but have not received payment for (also known as Accounts Receivable as it is money you are about to receive) Enter the value for last period and the current period.

(C) Unsold inventory. This is consuming cash but it is locked in the form of inventory. Enter the two periods

(D) Monies Owed to Me is the sum of B and C for each item

(E) What I Owe Suppliers. This is what you have to pay your suppliers each period

(F) Additional Monies I took out of the business. These are your Expenses.

(G) Assets I purchased for Cash. You may have paid cash for assets (as distinct from increasing your bank loan usually reserved for more expensive assets)

(H) Net Cashflow. Eh Voila! The difference between monies coming in and those going out.

Now you can check your accounting by looking at two balancing line items:

(I) The value of your business bank account at the end of both periods.

In this example the business had $50,000 cash on hand in period 1 and had gone down to $38,000 in period 2 for a cash reduction of $12,000

(J) The value of your bank loan (in this example the owner decided he had enough cash to reduce his loan by $10,000 ($120,000-$110,000)

The difference between (I) and (K) is a cash consumption of $2,000 which tallies with our Net Cashflow.

This business required an additional $2,000 cash from period 1 to period 2.

SPECIAL NOTE

We are just looking at Cashflow. It may well be that the business is very healthy and that cash infusion helped the business grow and make greater profit. In turn we reinvested that profit in our business. For example, we saw that the owner decided to reduce her bank loan by $10,000.

The important points are:

We understand what happened to our cash—where it came from, where it went, and where it is stagnating (in working capital)

We know we needed an extra $2,000 allowing us to plan to provide for it going forward.

Please do this exercise for your business. If you have a negative cashflow be sure you know why and how you can fund it. If you can’t ,you need to start looking at how you might reduce expenses, get your customers to pay sooner or delay paying your suppliers through legitimate means (like vendor managed inventory or extended paymnet terms).

Now you have a baseline we can move to the next phase: forecasting cashflows which we will deal with in a later post.

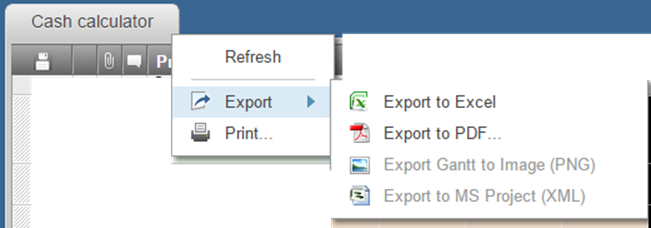

Here is an interactive worksheet for you to experiment with cash flow in your business. The yellow fields are the input fields. Once you have filled it in you can print it off or save it as an Excel spreadsheet.

(right click on the "cash calculator" tab) and is our gift you.

Let us know if this was helpful and what is the biggest challenge facing you in your business

Comments