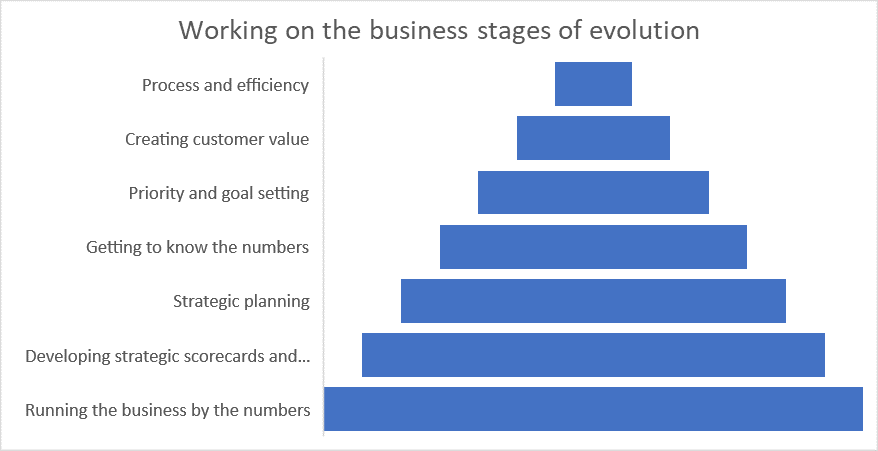

Through our observation and studies, we have identified 7 stages of evolution that an organization goes through when it comes to working ON the business.

These stages are not definitive many organizations show tendencies to mix components of each stage yet the successfuls master each stage before progressing in an effective manner to the next.

There are many conditions that determine the velocity of the evolution but in the main the key variables that create either constrains or rapid progress include

- Leadership

- Culture

- Money