Wouldn’t it be great if you knew your business was a well-oiled machine capable of building wealth? All you need to do is to go the bank borrow their money at say 5% interest and put it into your business machine which converts it to a 20% return.

You pay back the bank and enjoy the fruits of your 15% return and you never needed to use a dime of your own money!

It is possible and requires you set up your Balance Sheet as a Wealth Creation Engine. Of course it is not straightforward, but there are basic disciplines you must master to get there.

Our research of successful business owners shows they are very comfortable and capable of leveraging debt (other people’s money). This post shows you how to use good debt and not fall prey to bad debt.

What is Debt?

Debt is Other People’s Money. We borrowed it from them and carries an interest charge. Sometimes we need that debt to cover near term expenses and so it is called Short Term Debt. At others we may need to invest in capital equipment like a car or a building—this is usually paid back over a longer term and is called, surprise! - Long Term Debt.

But at the end of the day, all of it is Other People’s money that has to be paid back in a timely manner.

What should I consider using Debt for?

Usually we borrow money from the bank. The chief concern of the bank manager is getting the loan plus interest paid—she will want to know how you are going to use the money, your ability to pay it back and what collateral you have in case your business underperforms:

- If the reason you want to borrow more money is to fix past business sins you are unlikely to get a favorable ear. Be brutal when answering this question because if you are not your bank manger will answer it for you

- If you want to fund working capital (buy more inventory, create spare cash to account for new customers who have yet to pay you) the only time to consider more debt is when your business is growing.

- Funding for fixed capital investments is usually funded by debt.

What is Good Debt?

Here at Science of Business Wealth we define Good Debt as:

Using Other People’s Money To Make More Money with Reasonable Risk

How Do I Know if I have Good Debt?

CLICK HERE FOR YOUR GOOD DEBT CALCULATOR YOU CAN VIEW ONLINE OR PRINT OFF THEN COME BACK AND FOLLOW THE TEXT --It is also embedded at the end of this post too.

You will need to look at your financial statements to fill in the easy good debt calculator. All businesses have to file annually so if that is all you have go and pull them out.

(NB Our research has shown the most successful companies create and analyze their financial statements monthly at a minimum. If there was only one piece of advice we could impart to you it is get a bookkeeper or create your own accounts in one of the readily available software tools)

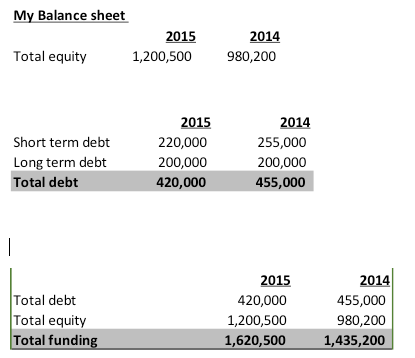

Take you financial statements for the end of 2015 and turn to the balance sheet. You will identify the equity number as at the end of 2015 and the end of 2014 (it will be listed as “Equity”) Also add up the two types of debt, short term and long term—it will be under the liabilities section of the balance sheet:

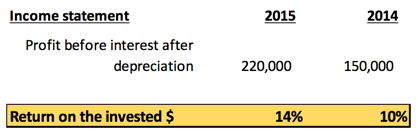

To determine return on that total funding investment we need to compare it with how much net profit did we make (Net profit is found on your Income Statement and is a number you should have in your head anyway)

In the above our return on our invested dollar is profit/total funding.

In 2014, $220,000 profit is 220,000/1,622,515 or 14%

Our friendly bank manger who we met earlier offered us a loan at 5% interest. We turned that borrowing into a return of 14% in 2014 and 10% in 2015. Both years the business Made More Money by using Other People’s Money. Great job!!

Evaluating Risk

Hold on though, our maxim is:

Using Other People’s Money To Make More Money with Reasonable Risk

A good rule of thumb is to for the return on your borrowings to be approximately 3 times your cost of debt.

You can work out you own average cost of debt (the average interest you pay on your loans—usually it will approximate out at average bank rate)

(WARNING: MANY SMALL BUSINESSES ARE FINANCING THEIR DEBT WITH CREDIT CARDS THAT MAY HAVE INTEREST RATES IN THE 18-20% RANGE. THAT IS OK IF YOU ARE MAKING A RETURN OF THREE TIMES THAT MUCH, I.E. 50-60%. AS THIS TYPE OF RETURN IS RARE YOUR STRATEGY HERE WOULD BE TO REDUCE YOUR DEBT NOT GO AND GET MORE)

In our working example we borrowed at 5% interest. Our safety margin would suggest we look to make three times that or 15% return. We achieved 10% in 2014 and has improved to 14% in 2015. So a word of caution here. Yes the business has done well leveraging debt. But a sudden downturn may impact your ability to service that debt. Certainly, at 10% you may want to be cautious about borrowing more at 5%. But if you continue like youa rein 2015 you are doing well and funding your growing business with more debt is a good strategy.

Another factor that you would consider is the proportion of Other People’s Money to Your Own Money and is known as the Debt to Equity ratio. We will look at this in a different post.

We are sure you will have questions. Please reach out to us at This email address is being protected from spambots. You need JavaScript enabled to view it. and both Mick and Andre will review and get back to you. Don't fall prey to bad debt, Make it work for you!

Here is an interactive worksheet for you to experiment with debt in your business. There is an example and a blank worksheet for you to fill in.

have fun!.

Comments